wyoming tax rates for retirees

Wyoming - Married Filing Jointly Tax Brackets. Wyoming tops the list of friendliest tax states for retirees.

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

In addition to those general sales tax rates local county and city governments can levy lodging taxes which apply to hotels and motels.

. PDF Tax Withholding Change PDF Resources Prudential Life Insurance Reasons. What taxes do retirees pay in Wyoming. In fact its one of the lowest tax states for residents of any age.

Marginal Income Tax Rates. Wyoming is no exception and thankfully tax rates are so low that the state has earned a reputation for it. Wyomings property tax rate is 115 for industrial property and 95 for commercial.

Wyoming is very tax-friendly toward retirees. Prescriptions are tax-free and so are groceries. Total tax burden is 99 - Wyoming has the second lowest tax burden of all the states - making it a very tax friendly state.

Wyoming is very tax-friendly toward retirees. Withdrawals from retirement accounts are not taxed. Social Security income is not taxed.

Nor does Wyoming assess any tax on retirement income earned and received. There is no state income tax the primary reason that. Wyoming has no state income.

These taxes can be as high as 5. There is zero state income tax in Wyoming and that applies to retirement. State tax rates and rules for income sales property estate and other taxes that impact retirees.

Wyoming also does not have a corporate income tax. Social Security income is not taxed. Pension plan contribution rate information and history for WRS employers.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax. Wyomings sales tax is 4. Withdrawals from retirement accounts are not.

Because it has no income tax all pension Social Security and payments from retirement accounts are not taxed at the state level. Wyoming Is Income Tax Free Wyoming is one of seven states with no personal income tax. Is Wyoming Senior Friendly.

And the 10 least tax-friendly states for retirees opens in new tab. Total tax burden is 99 - Wyoming has the second lowest tax burden of all the states - making it a very tax friendly state.

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

Low Income Wyoming Residents Pay Higher Tax Rate Than The Wealthy Wyoming Public Media

State Tax Levels In The United States Wikipedia

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Finding A Tax Friendly State For Retirement Accounting Today

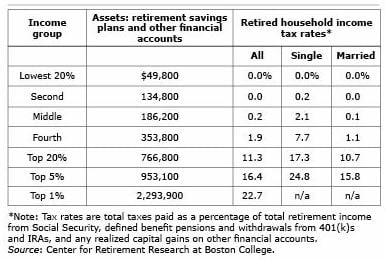

How Much Will Your Retirement Taxes Be Squared Away Blog

Military Retirement And State Income Tax Military Com

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

Wyoming Has 5th Lowest Tax Rates In The Country County 10

Wyoming Sales Tax Calculator And Local Rates 2021 Wise

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Wyoming Income Tax Calculator Smartasset

General Sales Taxes And Gross Receipts Taxes Urban Institute

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

Wyoming Wy State Income Tax Information

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Best Worst States To Retire In 2022 Guide

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates